Section 179 For Vehicles 2024 – They’re often talking about Section 179 — the “Hummer loophole,” which allows business owners who purchase heavy vehicles for work and deduct them through their business. There’s a lot more to Section . Section 179 has been referred to as the “SUV tax loophole” or “Hummer deduction” because it was often used to write off the purchase of qualifying vehicles. The positive impact of Section .

Section 179 For Vehicles 2024

Source : www.section179.orgUpdate] Section 179 Deduction Vehicle List 2024 | XOA TAX

Source : www.xoatax.comList of Vehicles Over 6000 lbs That Qualify for IRS Tax Benefit in

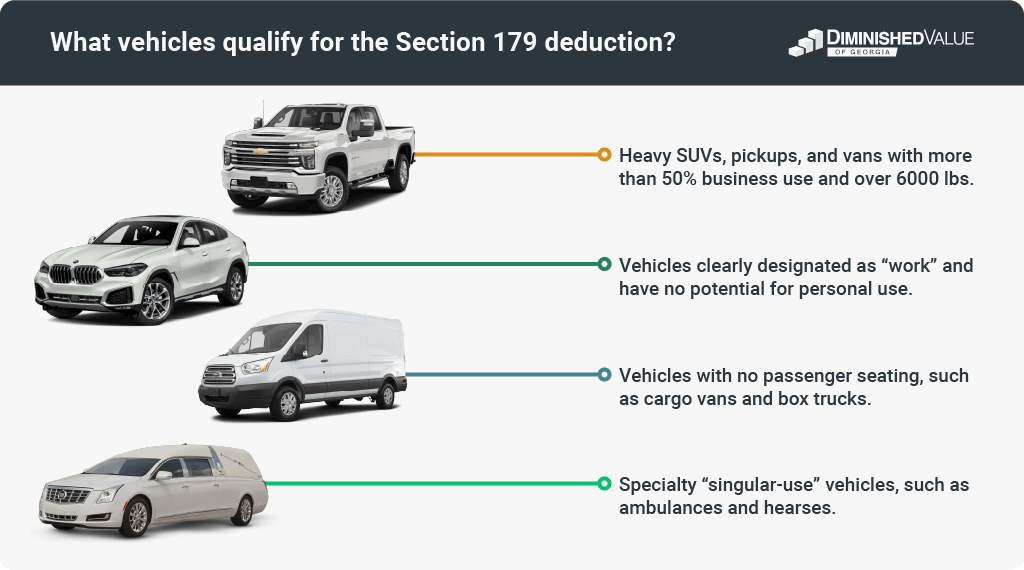

Source : diminishedvalueofgeorgia.comUpdate] Section 179 Deduction Vehicle List 2024 | XOA TAX

Source : www.xoatax.comSection 179 Eligible Vehicles at Bob Moore Auto Group

Source : www.bobmoore.comSection 179 Vehicles For 2024 Balboa Capital

Source : www.balboacapital.comSection 179 Creates Year End Tax Advantages on Business Equipment

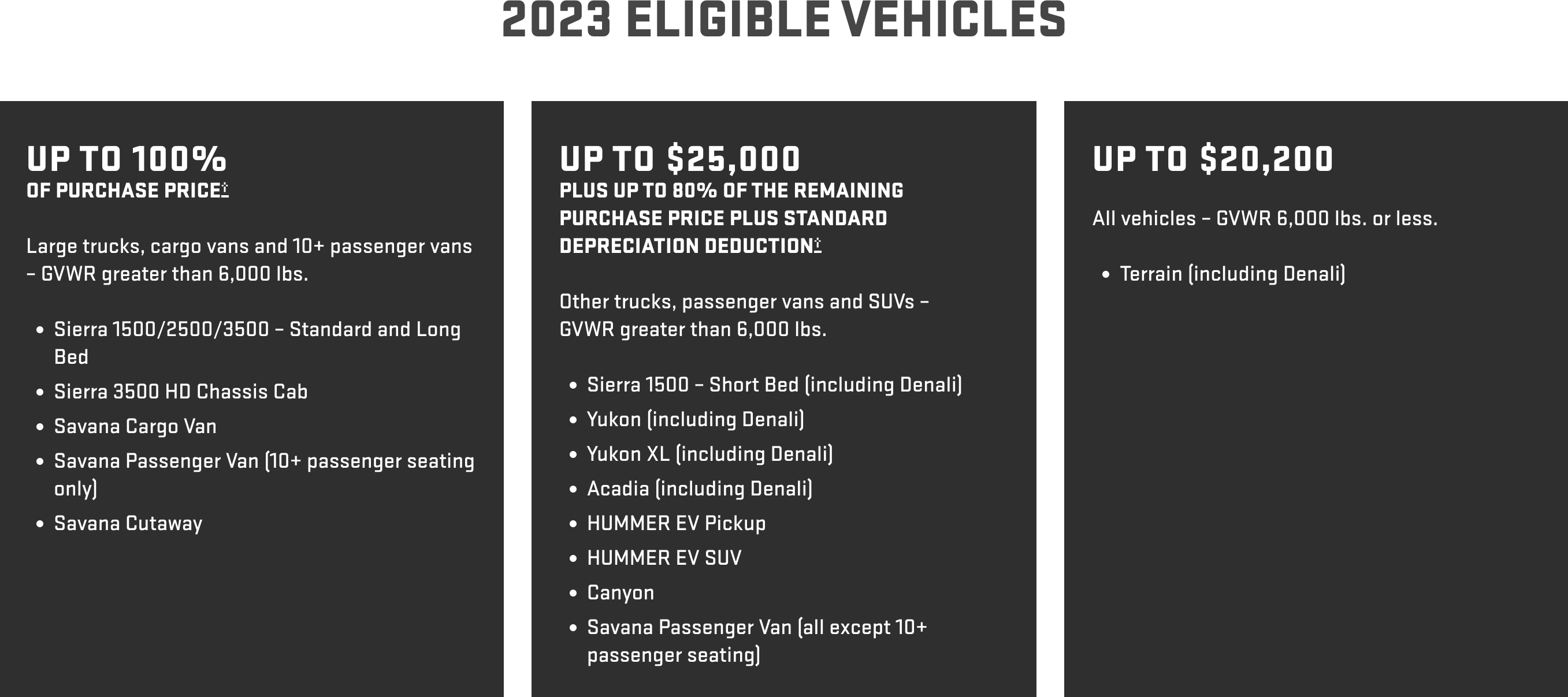

Source : www.loffler.comUnderstanding The Section 179 Deduction Coffman GMC

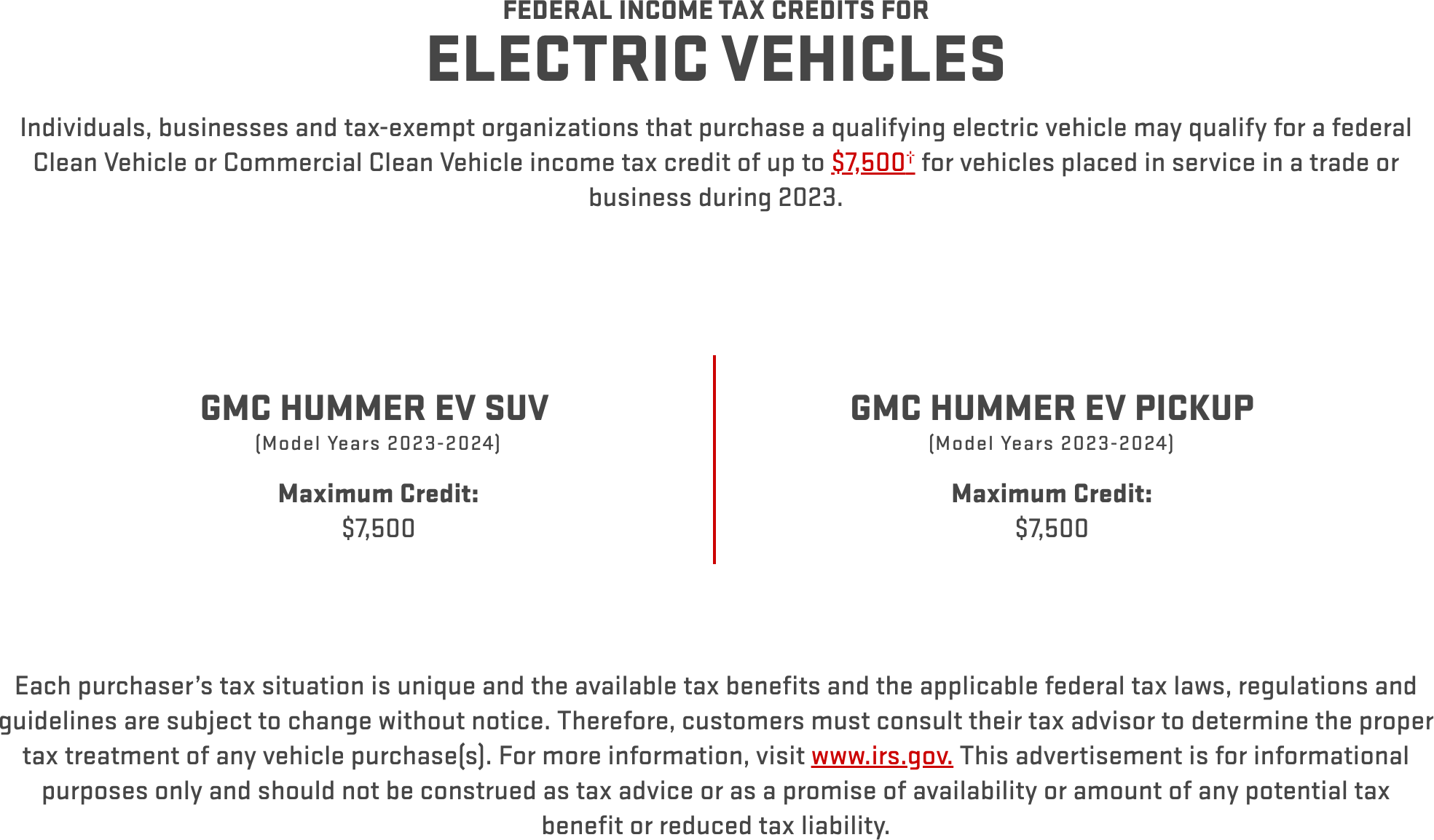

Source : www.coffmangmc.comHyundai Section 179 Rules & More | Hyundai Dealer Near Me

Source : www.northparkhyundai.comUnderstanding The Section 179 Deduction Coffman GMC

Source : www.coffmangmc.comSection 179 For Vehicles 2024 Section 179 Deduction – Section179.Org: Equipment and Vehicles Any equipment that you would ordinarily have to depreciate is eligible for the section 179 deduction as tangible personal property. Computers, cash registers and production . If you wonder why your self-employed neighbor is driving a behemoth rather than a normal vehicle Section 179 may offer some reason as he can deduct that vehicle, not just depreciate it. .

]]>